UTR full form , UTR full form in banking and Neft utr.

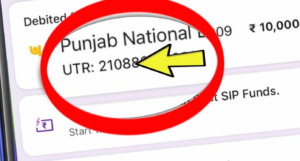

The UTR full form in banking is a Unique Transaction Reference. It is a number unique to each bank transaction. It is used in net banking. It is accompanied by a code of 22 or 16 characters in each transaction. UTR can be used to track the transfer of money. It is generally used in IMPS, NEFT, or RTGS transactions. Although the UTR format is different for each of these. Thus, these can easily be identified by a UTR number.

It serves as a reference number. RTGS was initiated in 2004. NEFT was initiated in 2005 and IMPS in 2010. Therefore, in 2004, UTR first came into use along with RTGS. This number is automatically produced by the banking system. It can also be used to infer the bank of the sender, the date of the transaction, etc.

Net Banking

Financial transactions that take place through the Internet undergo net banking. It is an all-in-one online resource for all modern banking requirements. It includes money transfers, checking account balances and statements, ordering checkbooks and bank cards, and making investments in securities on the stock market. It is extremely beneficial since it is available round-the-clock. It is time-saving and constantly monitored. It also makes bill payments easier.. Therefore, one might wish to navigate their transaction. This all can be possible using the UTR number.

NEFT, RTGS, and IMPS

UTR is produced for NEFT, RTGS as well as IMPS.

NEFT:

National Electronic Money Transfer (NEFT) is maintained by the Reserve Bank of India. The setup was generated and kept up to date by the Institute for Development and Research in Banking Technology.

Read More: Salim Ali Birdman of India , his Age, Career and Death.

RTGS:

RTG full form is Real Time Gross Settlement. It is a system that allows for the continuous and real-time settlement of fund transfers on a transaction-by-transaction basis. Real-Time considers processing instructions as soon as they are received. Gross Settlement refers to the individual settlement of every funds transfer order.

IMPS:

Immediate Payment Service or IMPS is an electronic money transfer mechanism for fast payments between banks. It provides an interbank electronic fund transfer service through mobile devices. Including holidays, The service is achievable every day of the year.

UTR Format:

UTR number check is a 16 or 22-character number code. It depends on the type of transaction made. It is 16 16-character-long code for NEFT. And 22 number characters long code for RTGS. A lot of details can be deducted from a UTR number because of its format. For example, consider a UTR number code ZZZZRA YYYYMMDD########. This code is for an RTGS transaction.

The 22 characters in the code can be implied as follows: ZZZZ represents the IFSC code. It is the bank code of the sender. It is a unique code for each branch of each bank. But the first four characters remain the same for the same bank. In this, R represents RTGS here, and C is the representation of the channel of transaction. YYYYMMDD represents the date and this hashtag sign ######## represents the sequence number.

Use of UTR

A UTR number is mainly used to trail and identify financial transactions. If your fund transfers consume a longer time than usual or are stuck, or if you just wish to consider a transaction created in the past, you can use the UTR number to observe them. UTR is generated when funds are transferred between two bank accounts in India. It means it is produced during National Electronic Funds Transfer (NEFT) and during Real Time Gross Settlement (RTGS).

How to Track Transactions Using UTR

People can easily visit their bank’s mobile app or online banking account. The transaction’s status should be shown By using the UTR number to search for the important transfer in the past transfers section. They can also even call their bank and give them the UTR code to get information about the transaction.

UPI and RRN

The National Payments Corporation of India developed the immediate real-time payment system. It is known as the Unified Payments Interface. Transactions between individuals and merchants and between banks are made much easier by this interface.

It allows for the instant transfer of money between two bank accounts using mobile devices.RRN or Retrieval Reference Number is considered one of the most crucial parameters for agreement in a UPI transaction. The first four characters of Ann RRN represent Julia’s date.

Conclusion:

The UTR full form in banking is a Unique Transaction Reference. It is a number unique to each bank transaction. It is used in net banking. It serves as a reference number. RTGS was initiated in 2004. NEFT was initiated in 2005 and IMPS in 2010.UTR number check is a 16 or 22-character number code. It depends on the type of transaction made. It is 16 16-character-long code for NEFT.

FAQs:

What is neft utr full form ?

The UTR is a Unique Transaction Reference number for NEFT National Electronic Funds Transfer.

What is UTR full form in Hindi ?

UTR जिसका फुल फॉर्म “Unique Transaction Reference”.

What is UTR?

The UTR full form in banking is a Unique Transaction Reference. It is a number unique to each bank transaction. It is used in net banking.